What Small Businesses Need to Know About Sales Tax Rules

Running a small business can feel like juggling flaming swords while riding a unicycle. One moment you’re cheering a big sale, the next you’re buried in paperwork. Sales tax is one of those tricky topics that can trip you up fast if you’re not careful. But don’t worry — I’ve got you covered. Let’s walk through everything step by step so you can stay out of trouble and keep your focus on growing your business.

Key Takeaways

- Sales tax rules can vary widely by state and depend on economic nexus, not just physical presence.

- Most products are taxable, but essentials like groceries or prescriptions might be exempt.

- Services are a mixed bag — always double-check state rules before charging tax.

- Register for a sales tax permit before collecting any tax; it's your official green light.

- Use updated POS systems or online tools to calculate the right tax rates automatically.

- Keep clear, organized records to prepare for audits and make filing easier.

- Marketplace platforms often collect tax for you, but know your responsibilities for direct sales.

- Filing on time avoids penalties — stay proactive and set reminders.

- Leverage tech solutions like Avalara or TaxJar to simplify compliance.

- Staying informed and organized helps you stay stress-free and focused on growth.

Why You Need to Understand Sales Tax

Sales tax isn’t just a boring government thing you can ignore. Once you start selling products or services, chances are you owe someone, somewhere, a chunk of that money. Ignoring it can lead to fines, angry letters, and lots of stress. So, it’s better to tackle it head-on — like ripping off a band-aid, but with less wincing.

What Is Sales Tax Nexus (and Why Should You Care)?

"Nexus" might sound like a sci-fi term, but in tax world, it simply means a connection that makes you responsible for collecting sales tax in a state. You used to need a physical presence, like a shop or warehouse, to create nexus. But after the South Dakota v. Wayfair, Inc. (2018) ruling, states can now require you to collect sales tax just because of economic activity — even if you never set foot there.

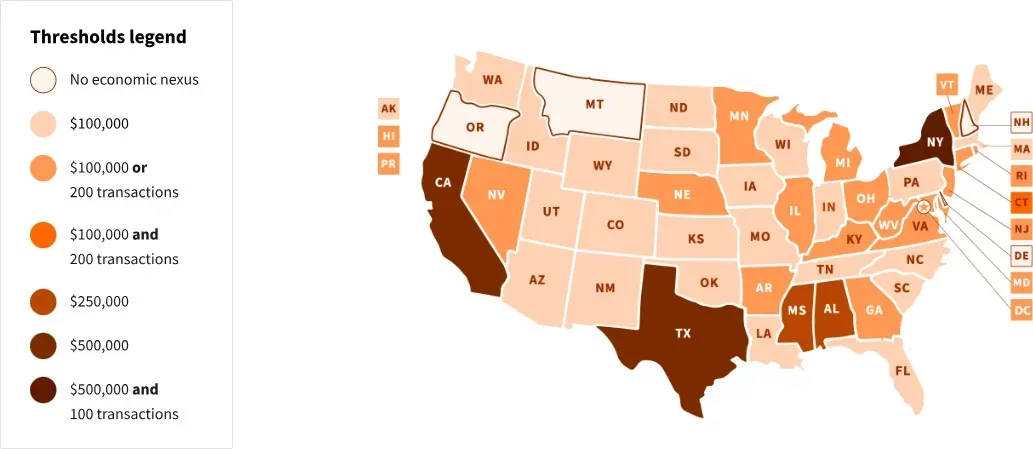

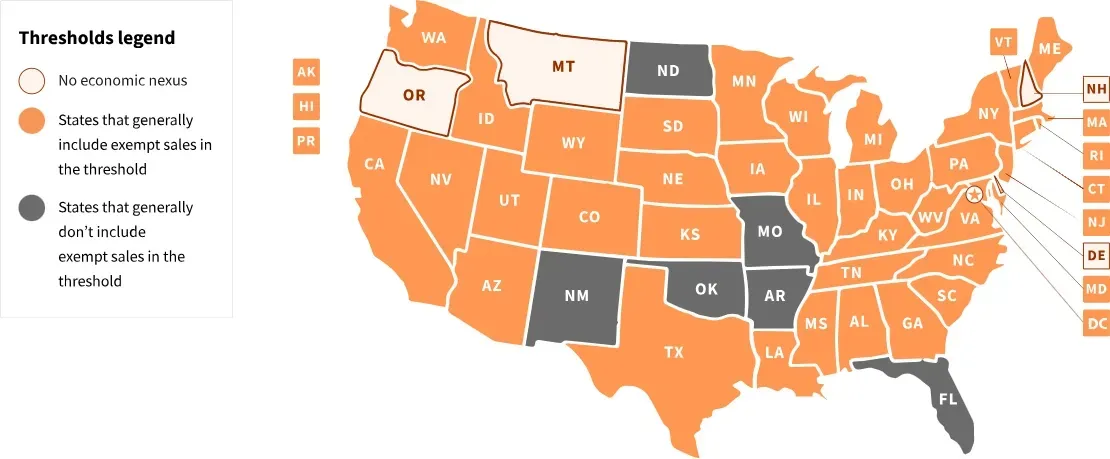

For example, if you sell more than $500,000 in California, you need to collect tax. In many states, the threshold is $100,000 or 200 transactions. But some states have higher thresholds, and others have started ditching the 200-transaction rule altogether. Check out the Sales Tax Institute’s Economic Nexus State Guide or Avalara’s blog on transaction-threshold eliminations for details.

For North Carolina, the economic nexus threshold is $100,000 in sales only.

Included transactions are:

- Gross sales sourced to the state

- Sum total sales price of tangible personal property

- Sum total sales price of digital property

- Sum total sales price of services

- Exempt sales

- Exempt services

- Sales made through a registered marketplace facilitator

Excluded transactions: None

Effective date: November 1, 2018

Evaluation period: Current or previous calendar year

Previous threshold rules: Sales or transaction volume prior to July 1, 2024

What’s Taxable and What’s Not?

Tax rules can feel like a choose-your-own-adventure book. Products are usually taxable — think clothes, gadgets, home decor. But some essentials like groceries or prescription meds often get a free pass.

Services? That’s where things get tricky. Some states tax services like repairs or cleaning, while others don’t touch them at all. Always double-check each state’s rules.

If you sell to nonprofits or resellers, they might be exempt — but only if they give you proper exemption certificates. Keep these on file, because tax auditors love to ask for them.

How to Register for Sales Tax

Once you know you have nexus, you need to register before collecting tax. Usually, this is done through your state’s tax department website. They’ll ask for basic info: business name, address, federal EIN, and what you sell.

After you register, they’ll send you a sales tax permit. Don’t start collecting until you have it, or you could face fines.

Collecting Sales Tax Like a Pro

With your permit in hand, you’re ready to collect tax. But don’t just guess the rate. You need to use the correct sales tax rates, which can include state, county, city, and special district taxes.

The easiest way? Use a POS system or ecommerce software that updates rates automatically. This saves you from headaches and customer complaints.

Always show sales tax clearly on receipts. People like knowing where their money goes, even if they grumble about it.

Filing and Paying Sales Tax

Collecting is only half the battle — you also need to file and pay those taxes. States decide how often you file (monthly, quarterly, or yearly), usually based on your sales volume.

Mark your deadlines on your calendar. Late filings can mean penalties.

When it’s time to pay, most states let you do it online, by mail, or via automated withdrawals. Online is fastest and keeps good records.

Keeping Your Records Clean

Good records are your best friend during tax season — or if you get audited. Keep copies of:

- Sales invoices and receipts

- Records of tax collected and paid

- Exemption certificates

- Reports from your POS or ecommerce systems

Organize these so you can find everything fast.

Handling Audits Without Tears

Audits can feel scary, but if you’re prepared, they’re more like a pop quiz than a nightmare. Having clear, organized records is your armor.

If the tax folks come knocking, show them your receipts, filings, and certificates. Being transparent and cooperative makes the process smoother.

Marketplace Facilitators: Your Helpful Sidekick

Selling on Amazon, Etsy, or similar? Good news: Marketplace facilitator laws often require these platforms to collect and remit sales tax for you.

However, know where they cover you and handle taxes on direct sales elsewhere. Don’t assume they do everything!

Check out Wipfli’s guide on marketplace facilitator obligations.

How do sales tax holidays work?

hey’re days when certain items are tax-free to encourage shopping. Great for promotions — but update your system so you don’t overcharge or undercharge.

Can I get exemptions as a small business?

Not usually for yourself, but you can make exempt sales to nonprofits or resellers — just get their certificates.

What tech can help?

Tools like Avalara, TaxJar, and others automate rates, filing, and reporting. They’re like a trusty co-pilot. See Gartner’s best tax software reviews 2025.

What about international sales?

U.S. sales tax usually doesn’t apply to exports. But watch for VAT or import duties elsewhere.

What happens if I pay late?

You might face interest, penalties, or even lose your permit. Stay on top of deadlines!

Final Thoughts

Sales tax might seem scarier than a horror movie marathon, but it doesn’t have to be. Understand nexus, know what’s taxable, register properly, and keep good records, and you’re in great shape. Stay proactive to avoid surprises. Take a deep breath, keep your paperwork tidy, and maybe reward yourself with a donut when you file on time. You’ve got this!