What Are the Duties of a Full-Charge Bookkeeper?

If you’re a business owner, managing finances accurately is critical to your long-term success. Whether you're a startup, a small business, or a growing company, you may have wondered if hiring a bookkeeper is enough—or if you need a full-charge bookkeeper. But what is a full-charge bookkeeper, and what exactly do they do?

At LTD Tax & Accounting, we often help clients navigate this question. Understanding the scope of full-charge bookkeeper duties can help you determine whether your business needs more than basic bookkeeping. In this article, we’ll outline the primary responsibilities, the differences between a full-charge bookkeeper and a regular bookkeeper, and what makes this role essential for many organizations.

What Is a Full-Charge Bookkeeper?

A full-charge bookkeeper is a financial professional responsible for managing all accounting functions within a business—essentially, they “take full charge” of the company’s books. Unlike a standard bookkeeper who may focus on day-to-day transactions like data entry and reconciling bank statements, a full-charge bookkeeper handles bookkeeping responsibilities from end to end, often up to the point of handing off financials to a CPA for tax preparation or audit.

They are typically entrusted with higher-level accounting tasks, such as preparing financial statements, managing payroll, and overseeing month-end and year-end closings. In smaller businesses, the full-charge bookkeeper may be the sole accounting professional on staff, functioning almost like a full charge accountant without the CPA credential.

Full-Charge Bookkeeper Duties: A Complete Overview

The role of a full-charge bookkeeper is comprehensive and may vary depending on the size and structure of the business. However, here are the most common full charge bookkeeper duties and responsibilities:

1. Recording and Categorizing Transactions

At the core of bookkeeping is the accurate recording of daily financial transactions. This includes:

- Invoices and payments

- Sales and revenue

- Purchases and expenses

- Asset and liability changes

A full-charge bookkeeper ensures every transaction is properly categorized in the accounting system (e.g., QuickBooks, Xero) for accurate financial tracking.

2. Accounts Payable and Receivable Management

Managing incoming and outgoing payments is a critical function. The full-charge bookkeeper:

- Generates invoices and tracks customer payments

- Follows up on overdue accounts (collections)

- Processes vendor bills and issues payments

- Monitors cash flow related to AR and AP

Keeping these cycles in check ensures the company stays financially healthy and vendors are paid on time.

3. Bank and Credit Card Reconciliations

One of the foundational bookkeepers duties is reconciling accounts regularly. A full-charge bookkeeper is responsible for:

- Matching bank statements with internal records

- Identifying and resolving discrepancies

- Reconciling credit card transactions

- Ensuring accurate cash balances

This task is essential for catching errors or fraudulent activity early.

4. Payroll Processing and Reporting

Payroll is often more complex than it seems. A full-charge bookkeeper typically:

- Calculates employee hours and wages

- Processes paychecks or direct deposits

- Manages withholdings for taxes and benefits

- Files payroll tax reports (e.g., IRS Form 941)

- Coordinates with payroll service providers, if applicable

Proper payroll handling ensures employees are paid accurately and the business remains compliant with labor and tax laws.

5. Month-End and Year-End Closings

One of the more advanced full charge bookkeeper duties includes closing the books at the end of each accounting period. This process involves:

- Reviewing and adjusting journal entries

- Reconciling ledger accounts

- Creating trial balances

- Preparing preliminary financial statements

This step provides a clean, organized set of books that are ready for CPA review or tax filing.

6. Preparation of Financial Statements

While CPAs may handle final reporting for tax purposes, full-charge bookkeepers often generate key financial reports, such as:

- Income Statements (Profit & Loss)

- Balance Sheets

- Cash Flow Statements

These reports provide management with a clear picture of business performance and inform important decisions.

7. Budgeting and Forecasting Support

In some businesses, the full-charge bookkeeper plays a key role in budgeting by:

- Analyzing historical spending patterns

- Projecting future revenue and expenses

- Assisting with financial planning

Though this task often falls under the role of a financial controller or CFO, many full-charge bookkeepers offer valuable insights for smaller businesses.

8. General Ledger Maintenance

The general ledger (GL) is the foundation of your financial records. The bookkeeper ensures:

- Proper journal entry posting

- Accrual adjustments (prepaids, depreciation, etc.)

- Accurate chart of accounts

A clean general ledger is crucial for reliable reporting and audit readiness.

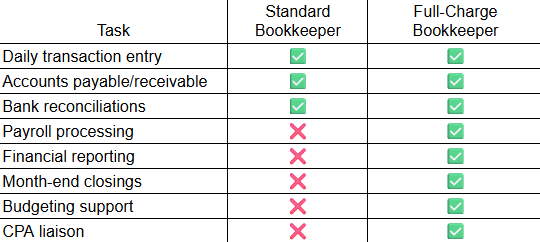

What Are Bookkeeping Duties vs. Full-Charge Duties?

To understand the value of a full-charge bookkeeper, it's helpful to compare their role to a standard bookkeeper. Here's a breakdown:

As this table shows, a full charge accountant brings a more strategic, big-picture approach, handling responsibilities that go beyond the basics of what are bookkeeping duties.

Skills and Qualifications of a Full-Charge Bookkeeper

If you're hiring a full-charge bookkeeper, here’s what to look for:

- Experience: Typically 3–5+ years in a bookkeeping or accounting role

- Software proficiency: QuickBooks, Excel, and other accounting platforms

- Attention to detail: Precision is critical for reconciliations and reporting

- Analytical skills: Ability to interpret financial data

- Organizational skills: Managing multiple accounts, vendors, and timelines

- Communication: Clear communication with team members, CPAs, and management

Many full-charge bookkeepers have accounting certifications, though a CPA license is not usually required.

When Should a Business Hire a Full-Charge Bookkeeper?

Not every business needs a full-charge bookkeeper—but many can benefit. You should consider hiring one if:

- Your business has grown beyond what basic bookkeeping can manage

- You need more accurate, up-to-date financial reports for decision-making

- You’re preparing for investor funding or a business loan

- You’ve been audited or anticipate a tax review

- You want someone to take ownership of your entire financial process

At LTD Tax & Accounting, we’ve seen firsthand how a qualified full-charge bookkeeper can reduce financial errors, save time, and support sustainable business growth.

Full-Charge Bookkeeping Services at LTD Tax & Accounting

If your business needs more than basic bookkeeping, our team at LTD Tax & Accounting offers tailored full-charge bookkeeping services that go beyond simple data entry. We understand the unique needs of small and medium-sized businesses and offer:

- Customized service packages to match your growth stage

- Clear monthly reporting

- Compliance with federal and state tax guidelines

- Coordination with your CPA or in-house accountant

- Ongoing support and financial clarity

Let us help you take control of your finances, streamline your operations, and free up your time to focus on what you do best—running your business.

Ready to Take Charge of Your Financials?

Hiring a full-charge bookkeeper is a strategic investment in your company’s stability and growth. From balancing the books to generating insightful financial reports, a full-charge bookkeeper brings a level of expertise and accountability that can transform the way you manage your business.

Need help managing your finances with accuracy and confidence?

Contact LTD Tax & Accounting today to learn how our full-charge bookkeeping services can bring clarity, control, and peace of mind to your business operations.

Let’s build a smarter financial future—together.