Finding the Right Small Business Accountant Near You for Long-Term Success

We specialize in helping small businesses thrive through expert financial guidance, accurate bookkeeping, strategic tax planning, and advisory services.

Who's the best small business accountant near me?

Every business owner has asked this question so many times. Surely, you can take advantage of some good accounting software. But learning the tool alone is already frustrating, not to mention the time it will take up on your schedule.

Needless to say, you need a CPA firm that understands your tax situation and will provide you reliable and professional services. More importantly, you need someone who will expertly handle all your business' financial records.

Navigating the financial landscape of small businesses can be a daunting task. As a small business owner, you're likely juggling multiple responsibilities, from managing operations to ensuring customer satisfaction. Amidst all these, keeping your finances in check is paramount. This is where finding the right small business accountant becomes crucial.

Accountants are not just number crunchers; they are strategic partners who help steer your business toward financial success. In this article, we'll explore how to find the perfect accountant for your small business.

Understanding Your Accounting Needs

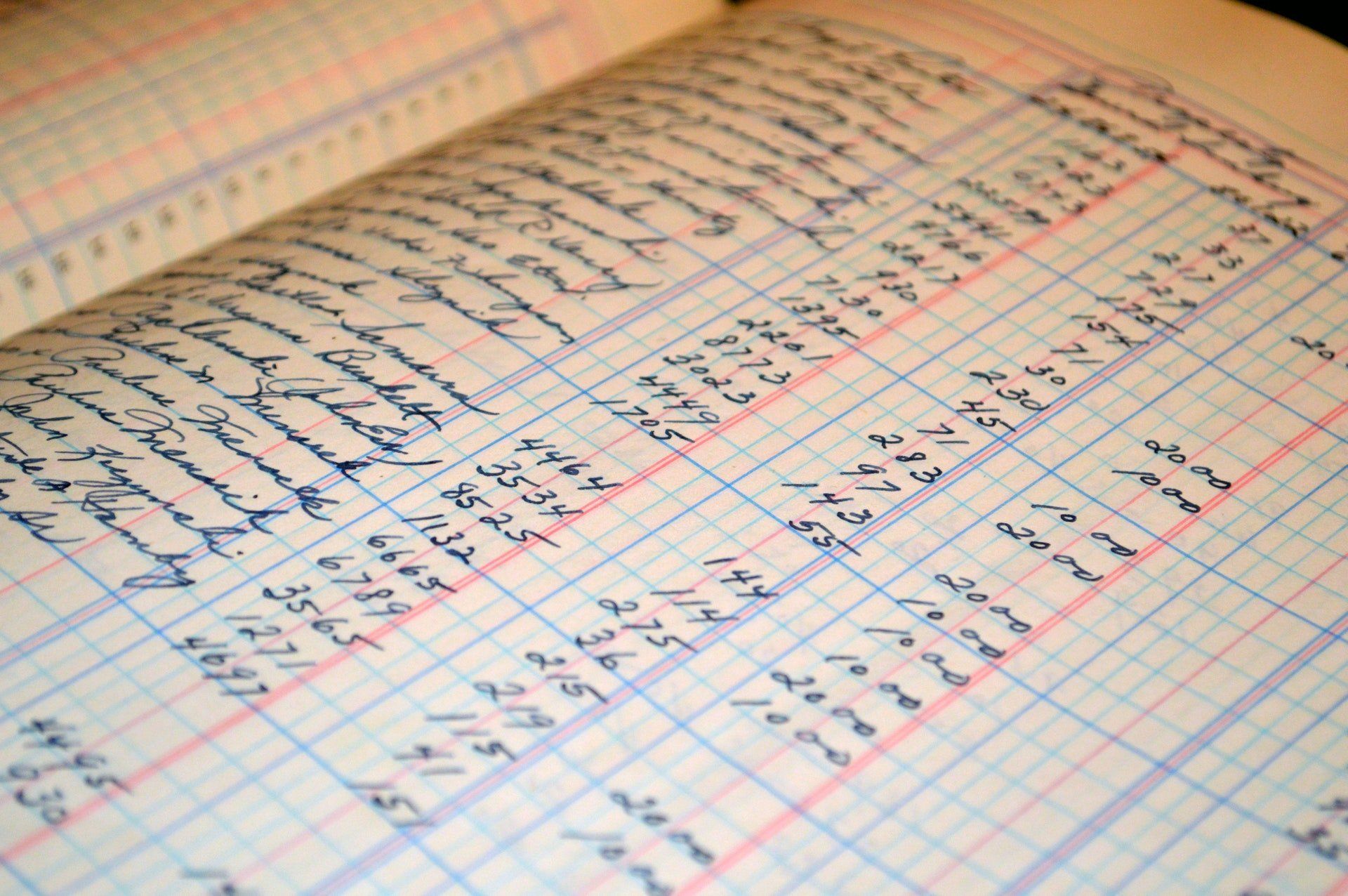

Before embarking on the search for an accountant, it's essential to understand your specific needs. Small business bookkeeping encompasses various tasks, including managing payroll, preparing tax returns, and creating financial reports. Determining the scope of services you require will narrow down your search and help you find an accountant with the right expertise.

The Role of a Small Business Accountant

An accountant's role extends beyond basic bookkeeping. They provide insights into cash flow management, assist with financial forecasting, and offer advice on tax planning. By understanding these facets, you can better assess your business's needs and find an accountant who can meet them.

Locating Accountants for Small Businesses Near You

The search for a competent accountant often begins with a simple query: "accountant near me for small business." However, finding a professional who aligns with your business goals requires more than just proximity.

Utilizing Local Resources

Networking within your local business community can be an effective way to find a trustworthy accountant. Attend local business events, join chambers of commerce, and engage with other small business owners. These connections can provide recommendations and insights into the accountants who are well-regarded in your area.

Online Searches and Reviews

In today’s digital age, online searches for "small business accountant near me" or "accounting firms near me" can yield a plethora of options. However, it's crucial to delve deeper than the first page of search results. Read reviews and testimonials to gauge the reputation and reliability of potential accountants. Websites such as Yelp or Google Reviews can offer candid feedback from other small business owners, helping you make an informed decision.

Evaluating Potential Accountants

Once you have a list of potential candidates, the next step is evaluation. This involves assessing their qualifications, experience, and compatibility with your business.

Qualifications and Certifications

Ensure that the accountant holds the necessary qualifications and certifications. A Certified Public Accountant (CPA) designation is a strong indicator of expertise and professionalism. CPAs are required to meet ongoing education requirements, ensuring they stay updated with the latest accounting practices and regulations.

Experience with Small Businesses

Experience in handling small business accounts is invaluable. An accountant familiar with the unique challenges and opportunities faced by small businesses will be better equipped to provide tailored advice and solutions.

Inquire about their experience in your industry, as sector-specific knowledge can be a significant advantage. For instance, if you operate in the renewable energy sector, an accountant with experience in that industry will understand its specific financial intricacies.

Compatibility and Communication

The relationship with your accountant should be one of collaboration and trust. Assess their communication style and ensure it aligns with your expectations. An accountant who can explain complex financial concepts in a simple, relatable manner will be a valuable asset.

During initial consultations, pay attention to how they address your concerns and whether they offer personalized insights. This will indicate their willingness to invest in your business’s success.

The Importance of Free Consultations

Many accounting firms offer a CPA free consultation as part of their services. This is an excellent opportunity to assess whether the accountant is the right fit for your business. During the consultation, discuss your financial needs and challenges, and observe how they propose to address them.

Questions to Ask During Consultations

Prepare a list of questions to make the most of your consultation. Here are some considerations:

- What experience do you have with businesses in my industry?

- How do you stay current with tax laws and regulations?

- Can you provide references from other small business clients?

- What is your fee structure, and are there any additional costs I should be aware of?

- How do you communicate with your clients, and what is your availability?

These questions will help you gauge their expertise and whether their approach aligns with your business needs.

Building a Long-Term Relationship

Once you've selected an accountant, focus on building a long-term relationship. Regular communication and transparency are key to ensuring that your accountant can provide the best possible service.

Regular Financial Reviews

Schedule regular reviews of your financial statements and performance metrics. This proactive approach allows you to address potential issues before they escalate and identify opportunities for growth and improvement.

Leveraging Their Expertise

An experienced accountant can be a strategic advisor in your business’s growth journey. Leverage their expertise for financial planning, budgeting, and strategic decision-making. Their insights can help you navigate challenges and capitalize on opportunities, ultimately contributing to your business's success.

Conclusion

Finding the right small business accountant is a crucial step in securing your business's financial health. By understanding your accounting needs, leveraging local and online resources, and thoroughly evaluating potential candidates, you can select an accountant who aligns with your business goals.

Remember, a great accountant is more than a service provider; they are a strategic partner in your business’s success. Invest time in finding the right fit, and you'll reap the benefits of informed financial decisions and sustainable growth.

LTD Tax Accounting – Your Trusted Partner in Small Business Success

Choosing the right accountant can make all the difference in your business’s success.

At LTD Tax Accounting, we specialize in helping small businesses thrive through expert financial guidance, accurate bookkeeping, strategic tax planning, and advisory services. We also offer reliable tax preparation services for businesses and individuals.

Whether you’re just starting out or scaling up, our personalized services are designed to fit your unique needs.

Let’s build your financial future together! contact LTD Tax Accounting today for a consultation.